Dunning

A document to be sent as a persistent demand for debt payment.

Dunning is a document to store and send as a persistent demand for debt payment against an unpaid Sales Invoice.

To access the Dunning list, go to:

Home > Accounting > Dunning

1. Prerequisites

Before creating a Dunning, there must be a Sales Invoice since it is created against it.

2. How to create a Dunning

A Dunning is created against a Sales Invoice.

For manual creation, follow these steps:

- Go to the Dunning list and click on New.

- Select an overdue Sales Invoice.

- Set Dunning Type in the dunning type link field.

- Set printing setting for the print template of the Dunning letter.

- The posting date and time will be set to current, you can edit after you tick the checkbox below Posting Time to make a backdated entry.

Save and Submit.

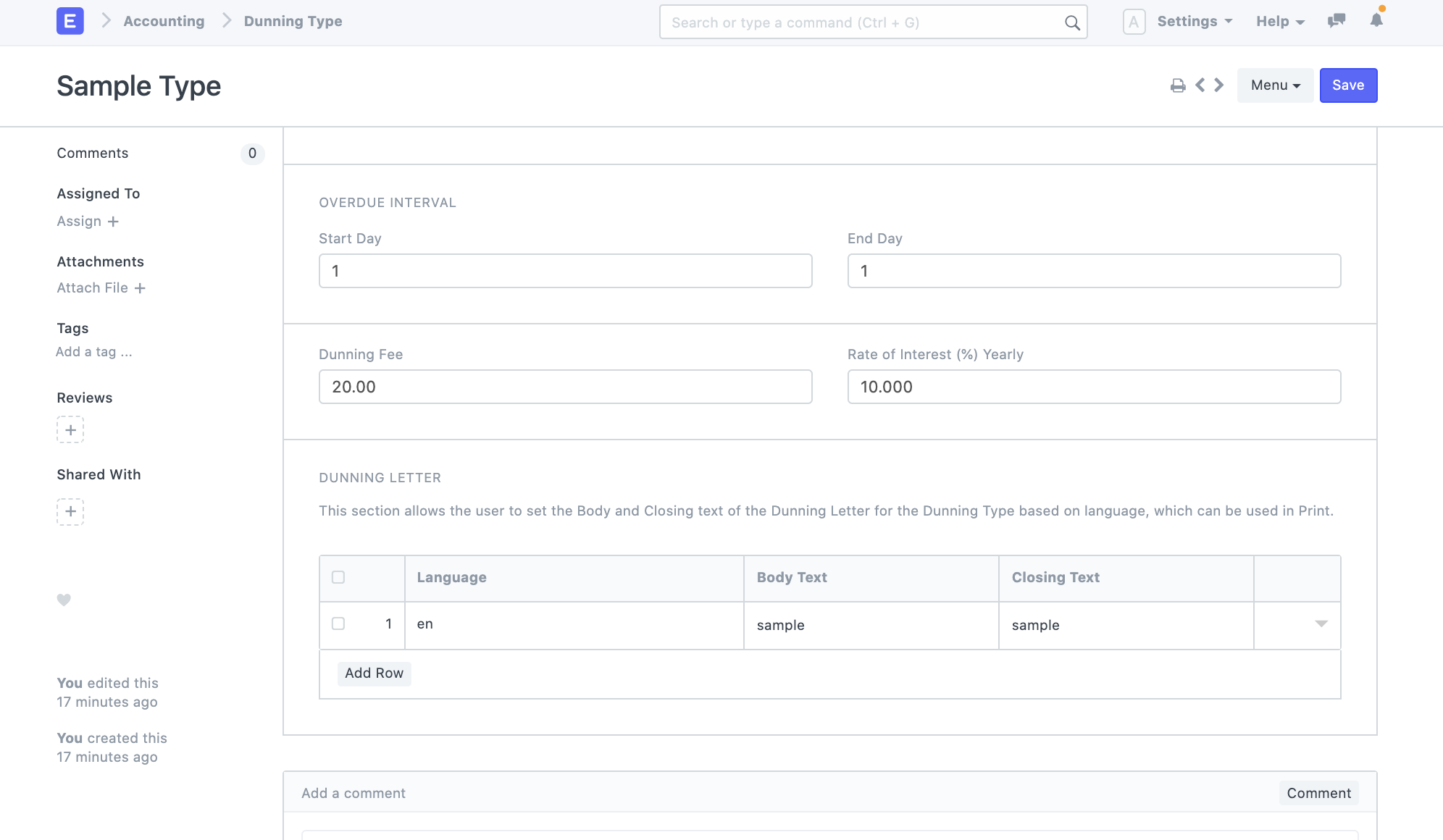

2.1 What is a Dunning Type

Dunning Type stores default values for overdue days, dunning fee, interest rate and text blocks to be included. For example, a Dunning Type "First Notice" will not have any fees, but Dunning Type "Second Notice" will have a dunning fee and interest charged on the outstanding amount.

2.2 Statuses

These are the statuses that are auto-assigned to Dunning.

- Draft: A draft is saved but yet to be submitted.

- Unresolved: The Dunning is unresolved when it is submitted but no payments have been received.

- Resolved: The Dunning is resolved when the outstanding payment has been received.

- Cancelled: A cancelled status is a cancelled Dunning document.

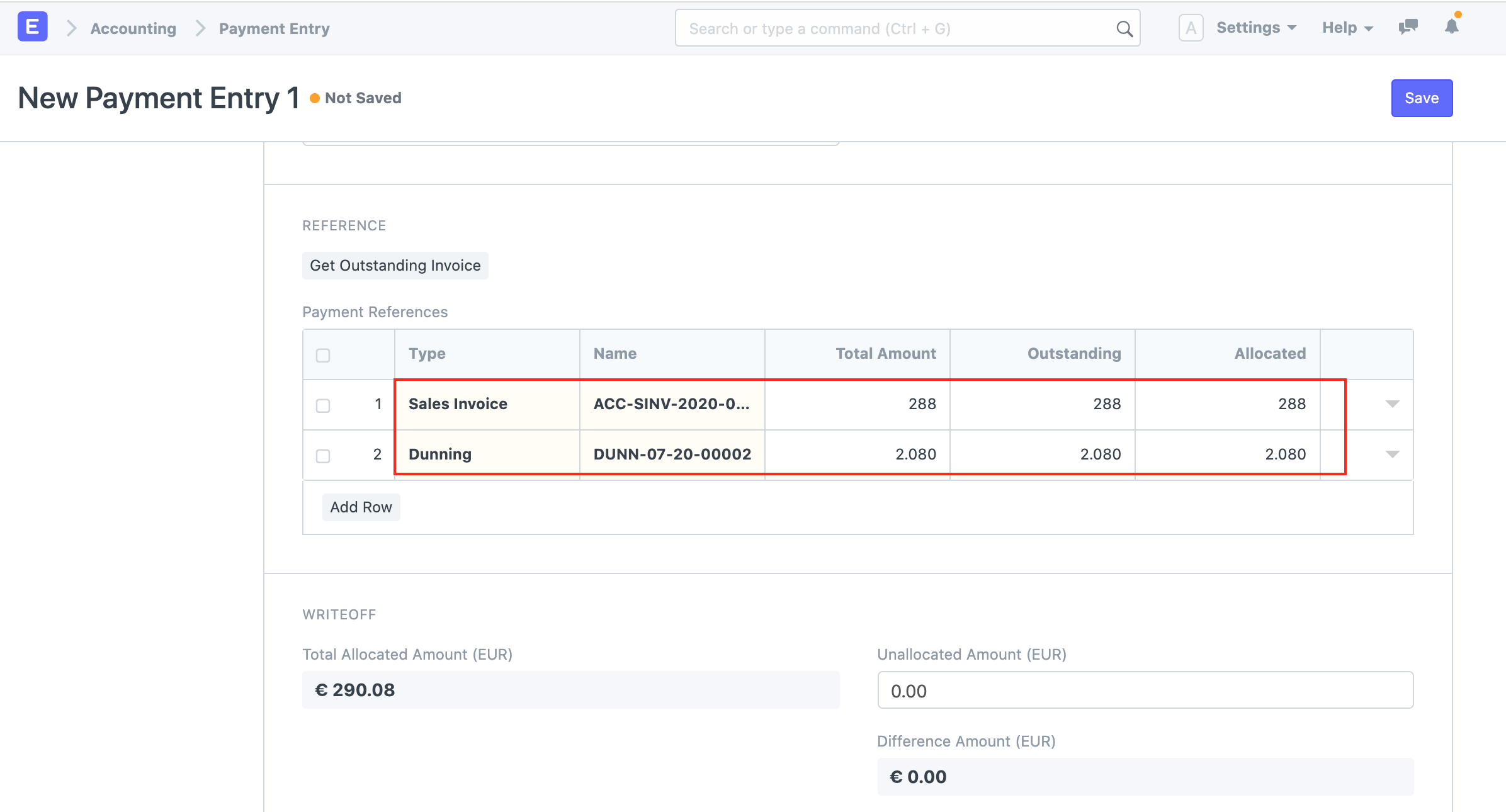

3. Payment

A Payment Entry can be created from a Dunning. It will be pulled together with the Sales Invoice details it is against.