Auto-generating e-Way Bill JSON from Sales Invoice

Under GST, transporters should carry an e-Way Bill when moving goods from one place to another when certain conditions are satisfied.

To help speed up creation of e-Way Bills, you can now auto-generate a JSON file from your ERPNext site which can be used to quickly generate an e-Way Bill on the GST e-Way Bill System.

Prerequisites

GST Accounts must be set in the GST Settings DocType.

Fields required to generate a valid e-Way Bill must be entered in Sales Invoice. To identify the required fields and for more information, you can refer to the JSON schema.

Instructions

On your ERPNext site:

After entering the required data, submit the Sales Invoice(s).

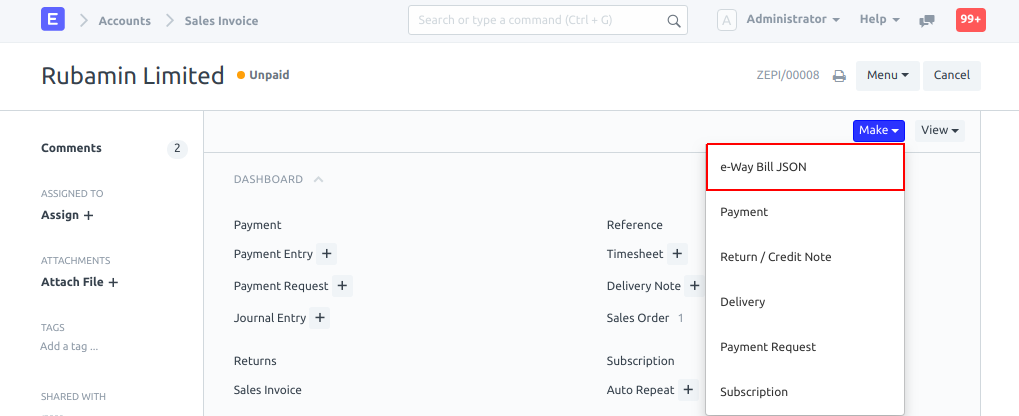

You should now see a button labelled e-Way Bill JSON under the Make menu at the top-right corner.

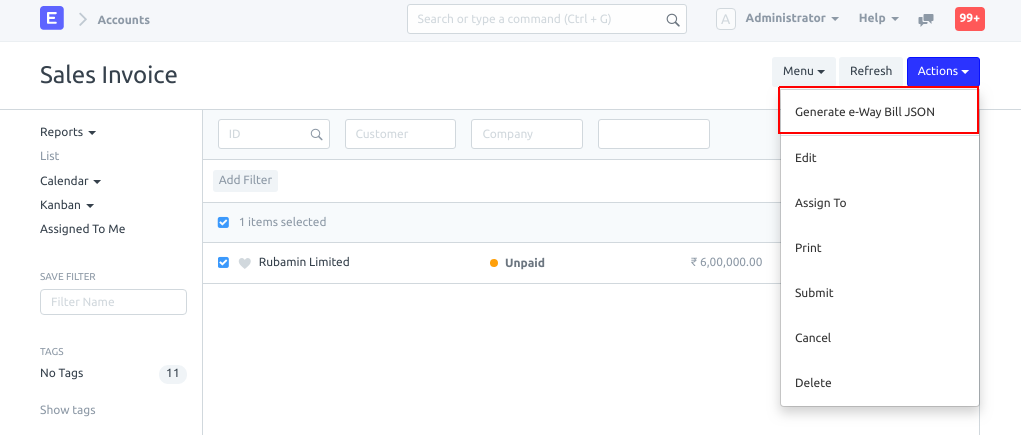

If you want to generate a JSON file for multiple invoices, you can select the relevant invoices from Sales Invoice List and find the Generate e-Way Bill JSON button under the Actions menu in the top-right corner.

Upon clicking this button, your data will be validated in accordance with the JSON schema and the auto-generated JSON file will be downloaded onto your device.

On the GST e-Way Bill System:

Log in to the GST e-Way Bill System using your credentials.

Under the e-Waybill section in the left sidebar, click on Generate Bulk.

Choose and upload the auto-generated file. You can safely ignore any warning regarding Document No. raised by the e-Way Bill System.

The e-Way Bill System should now display a description of the e-Way Bill(s) you are trying to generate. If it looks okay and no errors are encountered, you can proceed to generate the e-Way Bill(s) by clicking the Generate button.

You will now be able to view the e-Way Bill No. generated against your Sales Invoice(s). Please make a note of this as it will be useful later.

To print the e-Way Bill(s), go back to the e-Way Bill System Dashboard by clicking the icon and select Print EWB under the e-Waybill section.

You can now enter the e-Way Bill No. in your Sales Invoice for future reference.